Free Virtual Credit Card And Debit Card

If you are looking for a free virtual credit card or debit card but you don’t know where to go or which one should you consider. You are at the right place, this article will tell you about some best companies that provide virtual credit or debit cards that too for free or in some cases that would be paid.

A virtual card is a computer-generated credit/debit card (not a physical plastic card). They allow you to do online shopping without exposing your original or primary card numbers. These cards come with many features such as fraud protection and auto management on spend limits.

We have curated the list of Virtual Card/Debit Services, with their popular features and website links. The list contains both free and paid websites.

List of Best Free Virtual Credit Card and Debit Card

We have curated the list of Virtual Card/Debit Services, with their popular features and website links. The list contains both free and paid websites.

1. PSTNET virtual payment card

PSTNET issues virtual payment cards Visa/Mastercard in USD and EUR to pay for goods around the world and advertising accounts. Cards can be used to pay for popular services Steam, Spotify, Netflix, Patreon, and Unity 3D, as well as trading platforms such as Google Play, Apple App Store, Microsoft Store, PlayStation Store, Epic Games Store, and many others.

Advantages:

- Simple registration (you can use a Google/Telegram/Apple ID/WhatsApp account or email and password), the first card is available without documents (then simple verification)

- The largest number of premium BINs (US and European banks, 25+ BINs)

- Several types of cards for different purposes with different conditions, there are cards with 3D-Secure (confirmation of transactions using a code from SMS, codes are sent to your account and a telegram bot)

- Very fast support service @PST_support, working daily

- Convenient replenishment methods (cryptocurrency, Visa/Mastercard, bank transfers), and withdrawal of funds in USDT are available

- There is additional functionality for collaboration (managing team members, assigning roles, setting limits, a replenishment request system, reports, etc.)

- Advanced two-factor authentication system and Telegram bot for service notifications

- Generous referral program, rewards for reviews.

Especially for arbitration teams and those who work solo with high turnover, PST.NET offers the best PST Private program on the market:

- 3% cashback on advertising expenses;

- Up to 100 free cards;

- Low commission from 3% on the market.

2. Blur Virtual Credit Card

Blur is a virtual card provider that helps you protect your payment bank transactions, privacy, and password from cybercrimes. It allows you to transact from a phone, browser, or tablet.

Advantages of Blur:

- You can generate a new credit card number for every purchase with Blur.

- The Blur software can sync securely across all devices.

- Blur’s security service can stop secret data collection, block hidden trackers, and more.

- You can open an account online with just one tap.

- It can encrypt your password.

3. Wise Virtual Credit Card

The wise platform freezes your virtual card after making every payment. This is done for security purposes and It enables you to securely purchase online products.

Advantages of Wise:

- It supports more than 50 different currencies for ease of payment.

- It allows you to use up to 3 cards at a time.

- Available for both purposes business or personal use.

- Helps you to securely purchase online products.

- The wise platform is available in more than 30 countries.

4. Privacy Virtual Credit Card

Privacy is a VCC service and its primary work is to protect your money while shopping online. It is one of the top virtual card service providers, it assigns a unique card number and works only with individual merchants. It allows you to turn off the subscription with just a single click.

Advantages of Privacy:

- Privacy also offers a convenient browser extension.

- It sends an instant notification when you transact.

- The card automatically gets blocked after the first use.

- Your card becomes unusable if your card number is exposed it will automatically become unusable.

5. Airtm Virtual Credit Card

Airtm helps you to pay money ultra-securely with its virtual card. It offers a real-time exchange rate while exchanging money. You can even use your dollar funds to use your card.

Advantages of Airtm:

- There is no requirement to keep a minimum balance.

- You can make online purchases in any currency.

- Provides 24×7 hours of support to users.

- You can pay by crypto as well for the card it provides.

- More than 800 banks allow adding money.

6. Advcash Virtual Credit Card

Advcash is also a great virtual card service provider and it provides a hassle-free online shopping experience. You can even transfer your funds to the existing visa card email addresses, and other users.

Advantages of Advcash:

- You can use this card in any ATM worldwide.

- You can check your transactions with just one or two mouse clicks.

- You can add multiple currencies within a single account.

- This platform allows instant exchange transactions without any hassle.

7. Bento Virtual Credit Card

This virtual card provider offers an easy way to manage your organization’s expenses and spending. Virtual cards can be generated and assigned multiple times from a single account.

Advantages of Bento:

- Card information is encrypted and securely stored in your account.

- The platform helps you to manage both virtual and physical cards.

- The card can be used instantly once it is issued.

- The card can be accessed by authorized users.

- It offers more security and speed than a traditional physical card.

8. Netspend Virtual Credit Card

This is another good virtual prepaid card provider that helps you make personalized cards with unique images and photos. They even send transaction alters as a text messages.

Advantages of Netspend:

- This virtual credit card service allows you to check your card account balance anywhere, anytime.

- With some simple steps, you can create a temporary card number.

- Netspend smart algorithm protects your card and if someone uses your card, it can detect it.

- Netspend cards can be used all over the country.

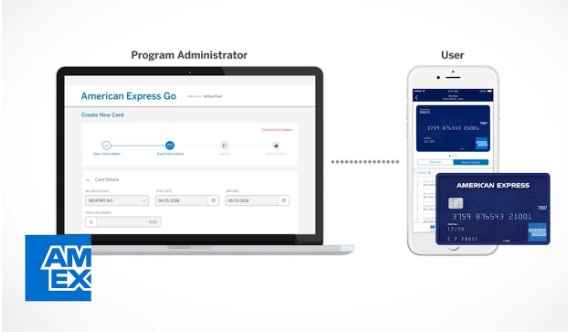

9. American Express Go Virtual Credit Card

As you know, American Express is a giant multinational credit and debit card provider. Its Go platform is a virtual US credit card provider that offers easy-to-use expense solutions. It is a very convenient solution for a person who is a freelancer, contractor, or recruiter to make payments from mobile.

Advantages of American Express Go:

- It’s very easy to create your virtual card.

- The platform helps you to keep track of your all transactions.

- The software also helps you to control your expenses.

- Even employees of your organization can add funds.

Read More: MX Player Custom Codec DTS & AC3 Custom Codec Download- Best In 2022

10. ecoVirtualcard Virtual Credit Card

Eco virtual card is a prepaid virtual card provider and its easy-to-use platform allows you to securely pay for goods online over a smartphone without even disclosing your personal information.

Advantages of eco Virtual card:

- The eco-virtual card provides free virtual Credit cards with instant and safe payment services.

- The platform provides 2 step verification process through the mobile phone.

- It is very easy to get a virtual prepaid Debit card PIN without any hassle.

- It has a USA service and gives multilingual support.

Mustafa Al Mahmud is the founder and owner of Gizmo Concept, a leading technology news and review site. With over 10 years of experience in the tech industry, Mustafa started Gizmo Concept in 2017 to provide honest, in-depth analysis and insights on the latest gadgets, apps, and tech trends. A self-proclaimed “tech geek,” Mustafa first developed a passion for technology as a computer science student at the Hi-Tech Institute of Engineering & Technology. After graduation, he worked at several top tech firms leading product development teams and honing his skills as both an engineer and innovator. However, he always dreamed of having his own platform to share his perspectives on the tech world. With the launch of Gizmo Concept, Mustafa has built an engaged community of tech enthusiasts who look to the site for trusted, informed takes on everything from smartphones to smart homes. Under his leadership, Gizmo Concept has become a top destination for tech reviews, news, and expert commentary. Outside of running Gizmo Concept, Mustafa is an avid traveler who enjoys experiencing new cultures and tech scenes worldwide. He also serves as a tech advisor and angel investor for several startups. Mustafa holds a B.S. in Computer Science from HIET.